This article was first published by F.O. Licht on 3rd April 2020. For an updated analysis, join F.O. Licht Managing Director Christoph Berg at our upcoming webinar,回应Covid-19:全球乙醇市场更新, taking place 27th May at 1pm BST.

The novel coronavirus (COVID-19) outbreak is sending shockwaves through the global economy. The impact is particularly acute in oil product markets, as restrictions on international travel and regional and local movement prevent people and goods from circulating freely, which takes a heavy toll on transport fuel demand.

在欧洲,对运动和社会接触的限制几乎与病毒本身一样快地蔓延,例如,扰乱工业生产和降低贸易和运输活动。而且,峰值尚未到来,因为官员警告案件的数量将继续增长。

An impact on the global biofuels market yet is hard to gauge. However, we take a quick look at some key markets, guided by the question to which extent the current projections for gasoline and gasoil and the existing blending targets would lower biodiesel and fuel ethanol demand.

Given the very fluid situation this assessment will have to be updated regularly.

An illustrating example – how EU road fuel demand is affected

As more countries expand quarantine measures and begin country-wide lockdowns, gasoline and diesel demand is set to plummet.

根据Ruck小时交通追踪者的数据,在米兰,马德里和巴黎等巨大影响城市的通勤交通达到了高达80%,而在采取监禁措施之前的平均水平相比。交通已经受到呼吁人们自愿从家中工作的影响。

| 欧盟:乙醇平衡(1,000 cubic metres) | ||||

| Jan/Dec | ||||

| 2020. | 2019年 | 2018年 | 2017年 | |

| Opening stocks | 1,029.6* | 952.6* | 890.5* | 887.0* |

| Output | ||||

| Fuel ethanol | 4200 .0 * | 4,847.0* | 4,834.0* | 4,611.0 * |

| 非燃料乙醇 | 2,450.0* | 2,113.0 * | 2,077.0 * | 2,036.0* |

| TOTAL | 6,650.0* | 6,960.0 * | 6,911.0 * | 6,647.0* |

| 进口 | 955.0 * | 1,235.8 * | 535.6* | 406.9* |

| Consumption | ||||

| 类ial ethanol | 1,900.0* | 1,417.0 * | 1,420.0 * | 1,323.0 * |

| Potable ethanol | 800.0 * | 870.0* | 860.0 * | 855.0* |

| Fuel ethanol | 4,430.0* | 5,037.0 * | 4,736.0 * | 4,570.0* |

| TOTAL | 7,130.0* | 7,324.0 * | 7,016.0* | 6,748.0* |

| 出口 | 580.0* | 794.7 * | 368.6 * | 302.3* |

| 结束股票 | 924.6 * | 1,029.6* | 952.6* | 890.5* |

| 资料来源:Licht Interactive数据 | ||||

| 欧盟:成名/ HVO平衡(1000吨) | ||||

| Jan/Dec | ||||

| 2020. | 2019年 | 2018年 | 2017年 | |

| Opening stocks | 7,600* | 7,107 * | 4,510* | 3,284* |

| Output | ||||

| 名声 | 9,800 * | 11,808* | 12,473 * | 11,523* |

| HVO | 3,885 * | 2,960 * | 2,741 * | 2,816* |

| TOTAL | 13,685 * | 14,768* | 15,214 * | 14,339* |

| 进口 | ||||

| 名声 | 1,800 | 3,458 | 3,554 | 1,226 |

| HVO | 0 * | 0 * | 0 * | 200* |

| TOTAL | 1,800* | 3,458* | 3,554 * | 1,426* |

| Consumption | ||||

| 名声 | 12,500 * | 13,248* | 12,497 * | 11,068 * |

| HVO | 3,400 * | 2,548 * | 2,337* | 2,532* |

| TOTAL | 15,900* | 15,796* | 14,834* | 13,600 * |

| 出口 | ||||

| 名声 | 1,500 | 1,666 | 1,158 | 595. |

| HVO | 200* | 271 * | 179* | 344* |

| TOTAL | 1,700 * | 1,937 * | 1,337* | 939 * |

| 结束股票 | 5,485* | 7,600* | 7,107 * | 4,510* |

| Source: F.O. Licht | ||||

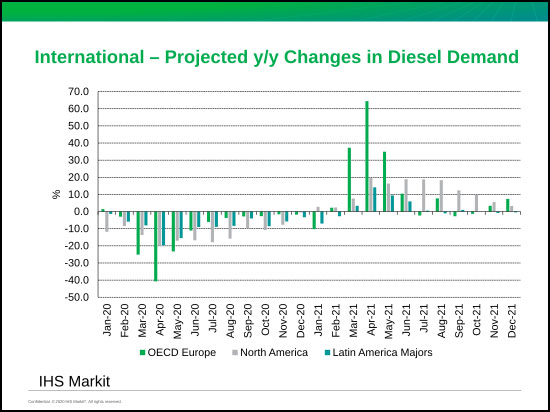

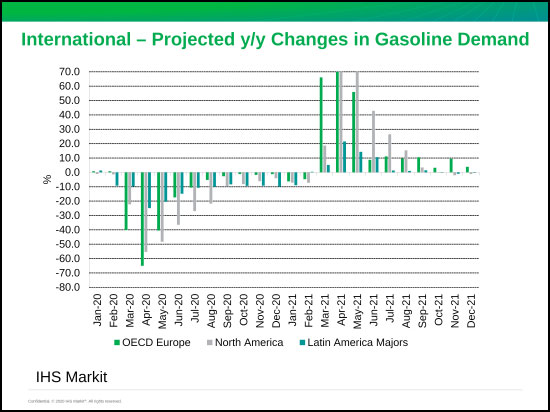

Against this background, IHS Markit is predicting a 65% y/y decline in April gasoline demand (a 1.3 mln barrels per day (bpd) drop off). Gasoil demand will fall by -40%, (close to 3.0 mln bpd) in the same month, with gasoil bunkers impacted, but the large part taken up by road diesel demand.

燃料需求尤其受到法国,意大利,西班牙和葡萄牙的影响;这些和其他南部国家通常享受夏季旅游和汽车租赁需求的相当大量的上升。IHS Markit对Q3的预测假设区域内部旅游急剧下降。

潜在的好处这前景正在增加in intra-market travel as consumers may opt to holiday domestically rather than the more expensive (and potentially riskier) option of international travel.

欧洲需求的另一个潜在的上行程序是较低的原油价格和较低的整体泵价格,这可能会提高驾驶季节的需求,假设旅行禁止被提升。

还有早期证据表明,由于中国的限制,有更多的人们愿意乘坐私家车或出租车旅行,而不是接受公共交通 - 这很可能在欧洲发生这种情况。

Later in 2020 and into 2021, the economic slowdown caused by the global disruptions will continue to impact gasoil and diesel demand, with factories and industrial plants running at lower levels. The potential upside for diesel and gasoil demand is that e-commerce activities - compensating for brick and mortar store closures - results in a higher number of deliveries carried by diesel-fueled vans and trucks.

Turbulent times ahead for EU biofuel producers

对于EU-27,2020年的柴油需求被认为收缩10%。柴油需求的预期下降与2020年的若干会员国中的生物柴油增长一致,当年10.0%Cal。可再生能源指令(红色)和6.0%温室气体减排目标的可再生能源目标在燃料质量指令中进入力量。

How do these two factors – the expected sharp downturn in economic activity over parts of 2020 and the mandated increases in biodiesel blending – translate into figures?

2019年,欧洲联盟估计估计了16.0万吨生物柴油,其中包括13.5mL脂肪酸甲酯(名称)和2.5mL的加氢处理植物油(HVO)。

在一个没有冠状病毒的世界中,生物柴油需求设定为增加12%至17.8毫升吨,其中3.5毫升的HVO和14.3万人的名望,大部分来自柴油使用的增长的大部分增加了一小部分生长。

The list of member states with strong y/y increases in 2020 biofuel quotas includes large fuel markets such as France (10.0% vs 7.0%), Italy (9.0% vs 8.0%), Poland (8.5% vs 8.0%) and Spain (8.5% vs 7.0%). Other important markets now also target higher biofuels use such as Austria (8.75% vs 5.75%), Finland (20.0% vs 18.0%) and the Netherlands (16.4% vs 12.5%). At the same time, the greenhouse gas (GHG) reduction targets in Germany and Sweden rise (to 6.0% from 4.0% and to 21.0% from 20.0% (only diesel), respectively).

The current projections translate into a slight decline in 2020 biodiesel demand, or a loss of 2 mln tonnes when compared with demand under “normal circumstances”. This may not sound impressive at first sight, but the devil is in the details of the EU biodiesel balance, and it can be expected that FAME from plant oils will suffer most from the demand-side contraction. Why is this the case?

首先,炼油厂宁愿在技术原因(能量含量,物理和化学特性)和更高的混合极限上混合HVO。该产品的欧盟范围内生产能力在2019年上涨,所以2020年市场上可提供近3.5毫升的吨。可以假设这笔吨位会发现它的市场。冠状病毒诱导的生产停止等危险因素(参见纳维斯最近的关于Porvoo的维护新闻)或集团外部和内部的供应链中的其他中断,但这也适用于其他燃料,也适用于进口,不仅进口,而且不仅适用于HVO。

| 欧洲:Delta 2020在各种场景下的名望需求 | |||

| Y / Y在柴油需求中变化% | 名声demand in mln tonnes | ...y/y change in % | ...y/y change in mln tonnes |

| 2.0 | 14.4 | 7.2 | 1.0 |

| 1.0 | 14.2 | 5.9 | 0.8 |

| 0.0 | 14.1 | 4.6 | 0.6 |

| -2.0 | 13.7 | 2.0 | 0.3 |

| -4.0 | 13.4 | -0.6 | -0.1. |

| -6.0. | 13.0 | -3.2 | -0.4 |

| -8.0 | 12.7 | -5.8 | -0.8 |

| -10.0 | 12.3 | -8.4 | -1.1 |

| -12.0 | 12.0 | -11.1. | -1.5 |

| -14.0 | 11.6 | -13.7 | -1.8 |

| -16.0 | 11.3 | -16.3 | -2.2 |

| -18.0 | 10.9 | -18.9 | -2.5 |

| -20.0 | 10.6 | -21.5 | -2.9 |

| 资料来源:Licht Interactive数据 | |||

其次,在市场上的双重计数规定(DC)固定在红色,其有利的温室气体排放和市场的事实之后,对市场上的废物的生物柴油(DAME和HVO)有强烈的偏好。基于作物的产品分享在红色和成员国立法中覆盖。最后但并非最不重要的是,一些成员国的高配额就是使用必要的直流生物燃料。2020年欧盟的直流生物柴油产量早于近600万吨,其中来自烹饪油(UCO)超过3毫升,而多百万吨的乐华被进口。

Clearly, the waste segment will also suffer from the lockdown, as e.g. the UCO supply will fall (closed restaurants, canteens e.g.), while the availability of imports of UCO and UCOME (mainly from China) will likely also decline. Nevertheless, DC biodiesel remains a highly sought product, and the EU market can absorb a lot. A wildcard here is a long supply-side disruption, e.g. due to problems with collecting UCO. The lockdowns in the EU have a devastating impact on the availability of UCO, collector say. Plant oil-based could be much more easily available, also due to the high stocks, and replace DC product. However, there are the caps on crop-based product which limit demand.

第三,进口植物油的成名将落下Y / Y,同时也是由于印度尼西亚产品的反补贴职责和那里的授权较高,但继续存在。阿根廷每年有税率为1.2万吨的进口配额,马来西亚应在2020年进行出口盈余。真实,冠状病毒和阿根廷的比索危机将推动通常预期的水平以下的卷,但在那里在2020年也将是重大进口。

Fourth, there was a built-up in biodiesel stocks in the EU in recent years. In 2018 and 2019, changes in tariffs lifted biodiesel imports to above 3 mln tonnes per annum. These stocks weigh on the market and may cut output once more.

We therefore see an 8% reduction in EU biodiesel output to 13.7 mln tonnes in 2020 a likely outcome, with FAME hitting a six-year low of less than 10 mln. The projected recovery for 2021 may boost demand and output.

The EU ethanol market will mostly likely be harder hit biodiesel as gasoline-powered passenger vehicles will bear the brunt of the slow-down in overall demand for transportation fuels. At the moment, we expect fuel ethanol consumption in 2020 to fall by around 12% to 4.43 mln cubic metres.

The decline in demand has triggered a sharp downturn in prices which hit a record low of below EUR400 per cubic metre in the last week of March. This compares with well over EUR600 before the crisis hit.

发展已强迫生产者做出反应。在法国,第2号乙醇制片人Cristalco表示,其植物已经减少了他们的速率。据报道,该国南部的顶点设施关闭了。在比利时,农业收入将使他们的植物在维护中将其植物留在维护中,奥尔基格屋正处于决定是否在鹿特丹(欧洲最大的植物)或根特的较小设施关闭其现场。总而言之,超过10亿升的能力目前是离线或在被关闭的过程中。

这必然会影响燃料乙醇生产,并且随着我们已经将数量降至约4.2升,12%较小。

虽然能力适应是一个反击,但改变生产组合是另一个。对消毒剂的需求飙升,一些欧洲生产者相信燃料市场中看到的大部分损失可能会在Covid-19危机的几个月内增加到该部门的销售额。

There is a wide range of estimates for the disinfectants market for none of which there is a tested data-base. At the lower end there are estimates of 20-30 ml of disinfectants demand per person and day for the most affected countries in the EU. This alone would translate into around 140-200 mln litres of additional demand per month. In some countries health authorities are calculating with 30 litres of disinfectants per person and year which would translate into around 600 mln litres of ethanol demand per month. Other estimates work with an additional 2020 ethanol demand for disinfectants in the order of almost 700 mln litres, which would also more than compensate for the loss in fuel consumption.

虽然相当令人印象深刻的一个人应该不会忘记that considerable logistical and legal challenges will have to be overcome before this volume can be achieved.

Corona削减了美国,巴西的生物燃料市场的增长前景

需求损失也是生物燃料部门的卡片United States. Before corona started to bite in, nationwide biodiesel demand was set to rise by 1 mln tonnes on the back of a higher biodiesel mandate in the Renewable Fuel Standard, an increase in the GHG reduction target under California’s Low Carbon Fuel Standard and the re-introduction of the Blender’s Tax Credit for biodiesel in late 2019.

How will the projected demand-side contraction in diesel demand (13%) impact the US biodiesel balance?

| U.S.A.: Ethanol Balance(1,000 cubic metres) | ||||

| Jan/Dec | ||||

| 2020. | 2019年 | 2018年 | 2017年 | |

| Opening stocks | 3,543.6* | 3,783.3 * | 3,709.1* | 3,002.9 * |

| Output | ||||

| Fuel ethanol | 50,400.0 * | 59,725.0. | 60,801.6 | 59,984 |

| 非燃料乙醇 | 2,400.0* | 1,600.0* | 1,575.0* | 1,550.0* |

| TOTAL | 52,800.0* | 61,325.0* | 62,376.6* | 61,534.0* |

| 进口 | 1,350.0* | 1,334.1. | 1,059.6 | 1,053.4 |

| Consumption | ||||

| 类ial ethanol | 2,000.0* | 1,070.0* | 1,047.0* | 903.0* |

| Potable ethanol | 815.0 * | 810.0* | 803.0 * | 797.0* |

| Fuel ethanol | 45,000.0* | 54,600.0 * | 54,165.0 * | 54,060.0 * |

| TOTAL | 47,815.0 * | 56,480.0 * | 56,015.0 * | 55,760.0* |

| 出口 | 6,100.0 * | 6,418.8 | 7,347.0 | 6,121.3 |

| 结束股票 | 3,778.6 * | 3,543.6* | 3,783.3 * | 3,709.1* |

| 资料来源:Licht Interactive数据 | ||||

How will the projected demand-side contraction in diesel demand (13%) impact the US biodiesel balance?

Assuming constant blending ratios, the 2020 biodiesel market is set for a small y/y increase to slightly above 9 mln tonnes. The coronavirus is seen costing almost 1 mln tonnes of “lost demand”. Regarding the FAME vs HVO competition, the availability of HVO rises also here.

The outlook for the ethanol market is considerably gloomier. Gasoline consumption is expected to tank by about 20% in 2020 and by 50% in Q2. This is due to the composition of the passenger car fleet which is predominantly gasoline-powered. As ethanol is blended at a relatively fixed rate of 10% vol., it will see a similar decline.

| U.s.a:Fame / HVO平衡(1000吨) | ||||

| Jan/Dec | ||||

| 2020. | 2019年 | 2018年 | 2017年 | |

| Opening stocks | 1,371.9* | 1,576.6 * | 1,300.7* | 1,432.7 * |

| Output | ||||

| 名声 | 5,670.0* | 5,742.3 * | 6,185.3* | 5,316.0* |

| HVO | 2,125.0* | 1,750.0* | 1,450.0 * | 1,300.0* |

| TOTAL | 7,795.0* | 7,492.3* | 7,635.3* | 6,616.0 * |

| 进口 | ||||

| 名声 | 600.0* | 591.6. | 564.0 | 1324.4 |

| HVO | 763.0* | 800.8* | 550.8* | 631.6 * |

| TOTAL | 1,363.0 * | 1,392.3 * | 1,114.7* | 1,955.9 * |

| Consumption | ||||

| 名声 | 6,070.0* | 6,032.1. | 6,311.9 | 6,611.6 |

| HVO | 2,900.0 * | 2,675.2* | 1,816.6* | 1,779.4* |

| TOTAL | 8,970.0* | 8,707.3 * | 8,128.5* | 8,391.1 * |

| 出口 | ||||

| 名声 | 400.0 * | 382.1. | 345.6 | 312.8 |

| TOTAL | 400.0 * | 382.1. | 345.6 | 312.8 |

| 结束股票 | 1,159.9 * | 1,371.9* | 1,576.6 * | 1,300.7* |

| 资料来源:Licht Interactive数据 | ||||

As diesel demand is less affected the discount for gasoline has reached the highest level since the 2008/09 recession. As a result, fuel ethanol prices have fallen to all-time lows and operators are suffering considerable losses.

将发生类似于欧盟(工业燃料)的替代过程,但这可能不太成功,有两个原因:

- the fuel ethanol market is about 11 times the size of the EU’s

- the population is about 60% that of the EU (including the UK which will be part of the common market at least until the end of the year).

This means that capacity will have to be adapted at a large scale and industry representatives have already announced that 3 bln gallons are currently in the process of being shut down. This would be equivalent to around 20% of total capacity.

就像其他市场一样,展望Brazil是为了增加2020年的混合份额。自2019年3月以来,巴西利亚将生物柴油从3月1日提升到12.0%,从11.0%增加到12.0%。预计将于3月2021年度提高到B-13。

Based on an 8% contraction in blending, this would lower 2020 biodiesel demand by 0.5 mln tonnes to 5.6 mln, still a 10% increase on 2019.

与此同时,乙醇市场将缩小三个原因:

- 与其他国家一样,巴西可能会陷入衰退,这将直接抵达由乘用车驱动的英里(其专门由乙醇或汽油/乙醇混合物提供)。

- the sharp price decline for gasoline will squeeze hydrous ethanol out of the market

- the relatively higher sugar price will prompt Brazilian millers to produce more of the sweetener at the expense of ethanol.

Some fuel/industrial substitution will take place, but the effect will be even less pronounced than in the EU or the USA.

| Brazil: Ethanol Balance(1,000 cubic metres) | ||||

| Apr/Mar | ||||

| 2020./21 | 2019年/20 | 2018年/19 | 2017/18 | |

| Opening stocks | 1,470.6 * | 1,608.6 * | 1,369.9* | 1,763.0* |

| Output | ||||

| Fuel ethanol | 29,400.0 * | 32,740.0 * | 30,797.9* | 25,834.0* |

| 非燃料乙醇 | 2,950.0 * | 2,460.0* | 2,318.1* | 1,944.5* |

| TOTAL | 32,350.0 * | 35,200.0* | 33,116.1* | 27,778.5 * |

| 进口 | 1,220.0* | 1,500.0 * | 1,518.0 | 1,758.1 |

| Consumption | ||||

| 类ial ethanol | 1,750.0* | 1,288.0* | 1,290.0 * | 1302 .0 * |

| Potable ethanol | 370.0* | 362.0 * | 360.0* | 357.0* |

| Fuel ethanol | 30,000.0* | 33,250.0 * | 30,875.0 * | 26,700.0* |

| TOTAL | 32,120.0* | 34,900.0 * | 32,525.0* | 28,359.0 * |

| 出口 | 1,400.0* | 1,938.0* | 1,870.4 | 1,570.7 |

| 结束股票 | 1,520.6 * | 1,470.6 * | 1,608.6 * | 1,369.9* |

| 资料来源:Licht Interactive数据 | ||||

| Brazil: FAME/HVO Balance(1000吨) | ||||

| Jan/Dec | Dec | Dec | Dec | |

| 2020. | 2019年 | 2018年 | 2017年 | |

| Opening stocks | 1,273.6* | 1,247.2 * | 1,217.0 * | 1,194.6 * |

| Output | ||||

| 名声 | 5,300.0 * | 5,193.0 | 4,708.0 | 3,776.3. |

| TOTAL | 5,300.0 * | 5,193.0 | 4,708.0 | 3,776.3. |

| Consumption | ||||

| 名声 | 5,620.0 * | 5,166.6 | 4,677.8 | 3,753.4 |

| TOTAL | 5,620.0 * | 5,166.6 | 4,677.8 | 3,753.4 |

| 结束股票 | 953.6 * | 1,273.6* | 1,247.2 * | 1,217.0 * |

| 资料来源:Licht Interactive数据 | ||||

The short-term outlook

At first sight, the current projection does not look too so bad for biodiesel. Rising mandates and the fact that vehicle fleets in the US and Brazil have a much lower diesel share means that it will be mainly growth prospects that will be affected.

然而,必须强调的是,前景基于H2 2020和2021期间的经济复苏。比最初预测的燃料使用下降率将使欧盟更大的生物柴油需求下降,并可能促使消费减少巴西和美国。

For ethanol a similar reasoning applies. Should the economic recovery be delayed, demand losses could be bigger, and the crisis of the industry could deepen.

The weaker prospects for 2020 will also cut capacity utilization sharply, mainly for FAME and ethanol:

- for FAME, there are more than 18 mln tonnes of operational production capacity in the EU, in the US more than 8 mln, while in Brazil, the nationwide total exceeds 9 mln.

- for ethanol, it is close to 48 mln tonnes in the US, 30 mln in Brazil and 4 mln in the EU.

In both cases, the earlier projected recovery in utilization rates in some regions and the prospects for an improvement in margins will be delayed.

Finally, the impact on feedstock and co-product markets should not be underestimated. The loss of 3.5 mln tonnes of biodiesel volume against earlier expectations means that earlier contracted feedstock tonnage (mainly plant oils) will become available for the market again. Lower biodiesel demand also cuts stocking requirements. As stocks are already elevated, these may now have to be released onto the market, possibly at very low prices. This is another heavy blow, especially for EU producers.

在乙醇中,甘蔗对绿色燃料的需求将在巴西缩小,但该卷将被加工成糖,其中价格对时期更有利可图。该国的玉米乙醇生产商也会受到困扰,并有报道称该部门的所有项目都在此刻持有。生产边缘深深的红色,可能是植物必须关闭。这主要是涉及纯玉米乙醇植物。

In the US, grain demand for ethanol may fall to around 4.6 bln bushels of corn (1 bu=25.4 kg) from 5.4 mln. This represents a decline of about 20 mln tonnes. This also means that 7 mln tonnes of animal feed (dried distiller grains) will be lost for the domestic and international feed industries. Prices have already reacted and are on the way up.

在欧洲,乙醇产量和需求下降将相对适中,因为消毒剂市场符合目前的预期,并且可以避免主要物流瓶颈。